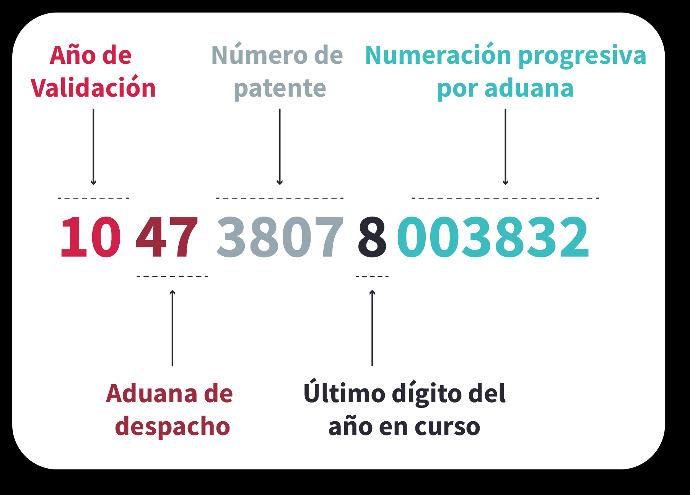

Structure of the request number

The request must include a key according to a structure that is provided by the SAT, this structure has fifteen digits, which correspond to:

2 digits, of the year of validation.

2 digits, of the dispatch customs office.

4 digits, of the number of the patent or authorization granted by the General Administration of Customs to the agent, customs representative or warehouse that promotes the dispatch. When this number is less than four digits, the necessary zeros must be added to complete 4 digits.

1 digit, must correspond to the last digit of the current year, except in the case of a consolidated petition initiated in the immediately preceding year or the original petition of a rectification.

6 digits, which will be progressively numbered by customs in which they are authorized for clearance, assigned by each agent, customs agent or warehouse, referring to all types of request.

Important:

Each of these groups of digits must be separated by two blank spaces, except between the digit that corresponds to the last digit of the current year and the six digits of the progressive numbering.

In the case of requests for rectification or complementary petitions, they must be identified with a new number.

What is the landed cost?

The landed cost is the total price of a product once it is delivered to the final customer. It takes into account the cost of a product from its manufacture, shipment in a container, to the buyer.

The calculation of the landed cost includes all the specific expenses associated with the shipment of each item, such as:

original price of the product

Shipping or transportation costs

Sea freight

Taxes

Duty

customs clearance

packing fees

Management and payments

Currency exchange (if applicable)

Calculate the landed cost with the sum of all these elements.

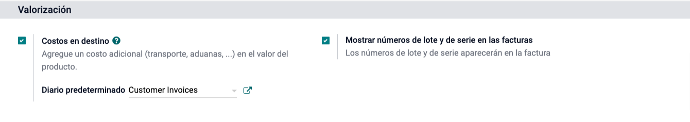

Note: The inventory valuation of the products to be affected must be FIFO.

Why is Landed Cost important for your company?

Calculating the landed cost will be an added value for your company for several reasons:

It will allow you to correctly calculate the profit of each product you ship, thus giving you a clear view of the performance of your business.

You will make sure to establish the most profitable price for each product. Once you know the real cost of each item, you will be closer to setting the sale price and the maximum discount you can offer.

You will obtain a clear analysis of your supply chain and all the associated costs, which will allow you to identify savings opportunities.

It is essential when making accurate financial reports. You will be able to see the value of the assets accurately and correctly visualize the monthly profit of your company.

Configure motions and Landed Cost in Odoo

The handling of requests and the Landed Cost are already in Odoo, it is a functionality that Odoo already has natively, here we tell you how you can configure it:

Go to Inventory, adjustments, search and select Destination costs.

Operations:

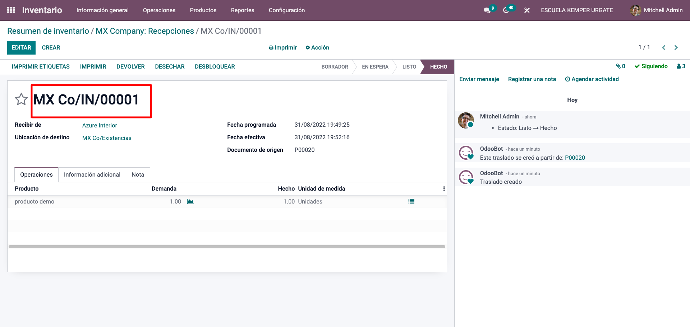

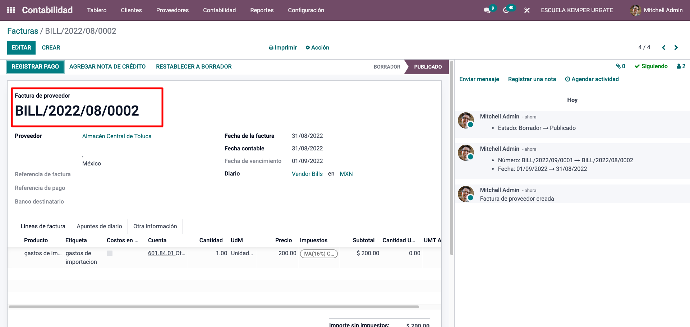

After making a purchase, the receipt of said merchandise must be made.

At the same time, the invoices corresponding to the extra costs must be charged.

When we already have the natural operations loaded in the system, we proceed to carry out the cost adjustment operation.

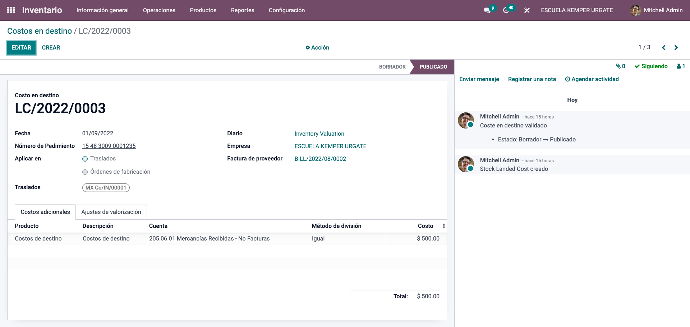

We're going to go to Inventory, go to the menu bar, Operations, destination costs and create an operation.

When validating, we can go to the valuation settings tab to see the new valuation.

Once the import request has been loaded, the products save that number for when they are going to be sold.

When the product is sold, it is necessary to create the invoice, Odoo will take the corresponding request from PEPS.