Discover in this blog post what is the stamping of electronic invoices, what is the process that must be followed and what is the importance for the SAT and taxpayers.

What is the stamping of electronic invoices?

Previously in the blog Facturación electrónica sencilla we told you what is the CFDI, what is the PAC and the process of electronic invoicing. In this blog post we will delve into the stamping of electronic invoices, but, before we start talking about it, there are some terms that you should keep in mind:

The CFDI is an XML document that verifies a transaction between seller and buyer.

A PAC is an entity that has the authorization of the SAT to verify and validate the structure of the XML, it ensures that the information is correct and at the time of validation it ensures that all the information of the tax receipts issued reaches the SAT.

So what is the stamping of electronic invoices? This is a process that occurs when generating the CFDI, a unique reference number is assigned that gives validity to said document, so that the CFDI is certified by the tax authority it must be stamped.

When there is no PAC, the taxpayers are in charge of stamping the invoices on the SAT portal, this process is usually automated and a software that contains an authorized PAC performs it automatically without the need for the taxpayer to do so manually.

In summary, when generating the electronic invoice, the stamping is done automatically and this is what gives it authenticity and makes it comply with the specifications established by the SAT.

Documents that can be stamped

All tax receipts related to an economic transaction must be stamped to be valid before the Treasury, some of the digital receipts that can be stamped are:

Eletronic bills

Payroll receipts

Credit notes

Bank statements

Payment notes

Payment receipts

Payment withholdings

Receipts of Honorary

Lease receipts

How to choose a software that helps stamp invoices and other electronic documents?

The invoice stamping service allows you to reduce financial risks, if what your company seeks is to reduce the time when issuing invoices, having a software will make the process easier and faster, here are some basic characteristics you should have:

Make sure it includes an endorsed PAC

The main characteristic that your software must have is that its PAC must be endorsed by the SAT, thus ensuring that the electronic invoices issued respect the legal requirements and the stamping is carried out under the rules established by law.

Adaptable to your company

Make sure it includes automation in the different accounting processes, adapts easily to your company's accounting and gives you the opportunity to completely eliminate manual processes.

Ability to generate numerous invoices

Research the software you are evaluating and make sure it has a very good capacity to support your company's billing volume, and make sure the information is stored securely.

Currently, there are several providers that offer invoice stamping, before choosing, compare and select the one that best suits the needs of your company.

Odoo simplifies the invoice stamping process

Stamping provides security and helps you keep track. By stamping a tax document, you can be sure that the invoice is authentic and both your company and your estate will be able to keep an order in the process.

Odoo has a set of applications that includes the Localización Mexicana since 2017 and is developed to make it fiscally suitable to operate in Mexico.

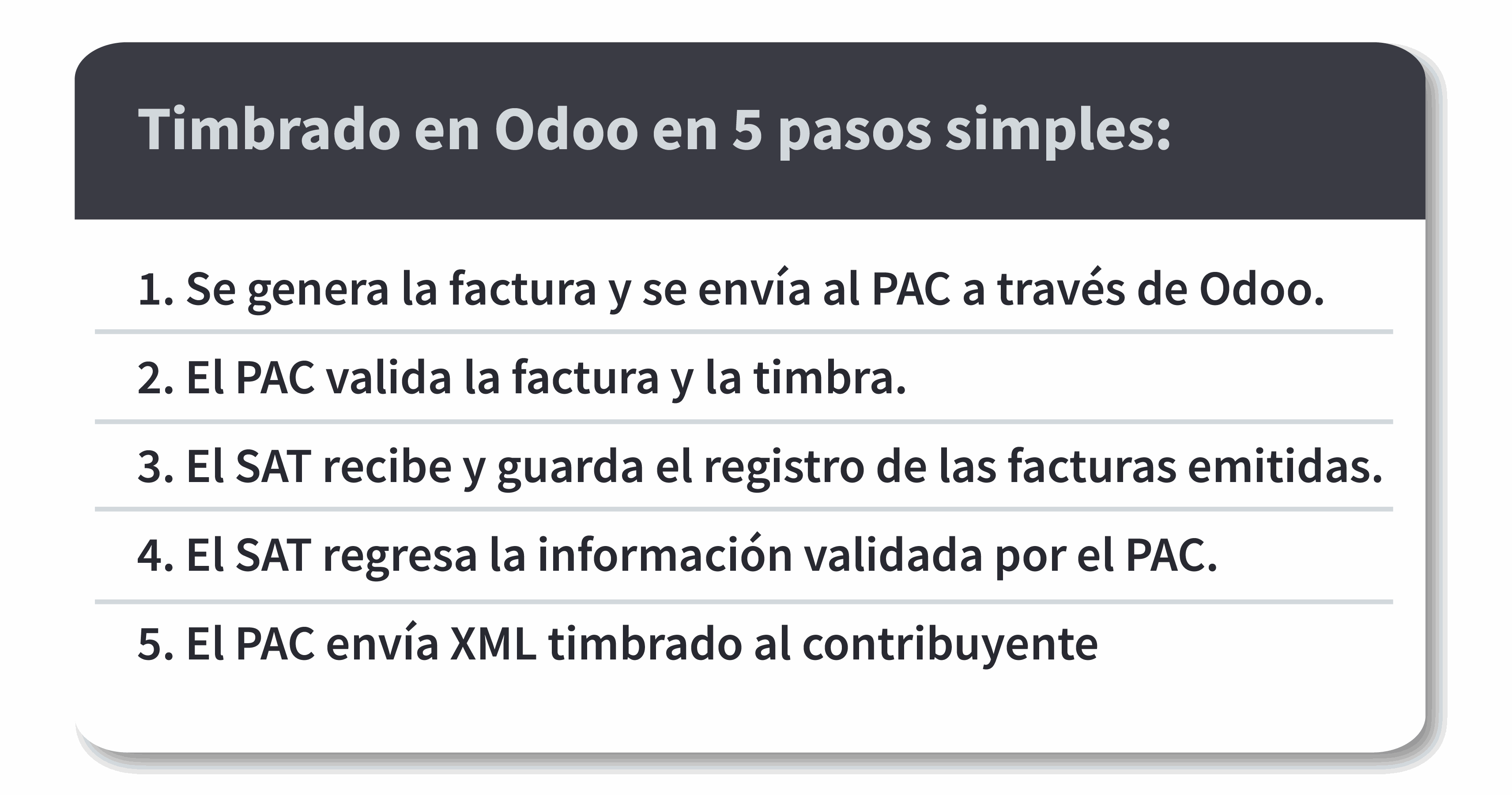

Here we share how ringing happens in Odoo in 5 simple steps:

Here we share how ringing happens in Odoo in 5 simple steps:

The invoice is generated and sent to the PAC through Odoo.

The PAC is in charge of validating the invoice, stamping it and sending it to the SAT.

The SAT receives and keeps the record of the invoices issued.

The SAT returns the information validated by the PAC.

Electronic invoicing is very necessary for companies, and it is very important to understand the process, do not be left with doubts! Visit our Facturación electrónica webinar where we took a tour of topics such as: SAT, PAC, CFDI, supplements, addenda, electronic accounting, DIOT, and more!

Now you know the importance of stamping in tax documents. If after reading this blog post you decide to start looking for software to automate your business processes, make sure you choose a provider that meets the needs and contributes to the success of your business.

Learn how Odoo Accounting can help automate your accounting processes.