The Costa Rica localization is an extension of the core modules adding the necessary functionalities so that companies can operate their accounting and finances in Odoo, complying with the main fiscal requirements of Costa Rica.

What is electronic invoicing?

Electronic Invoicing is an electronic document or voucher that supports the sale of a good or service, which must be generated, expressed, and transmitted in electronic format in the same act of purchase-sale or provision of a service.

In Costa Rica, it began at the beginning of 2019. At present, almost all taxpayers are obliged to invoice electronically, except for those who, by law, are authorized as non-emitting electronic receivers and those who have obtained a permit by part of the administration to continue billing manually.

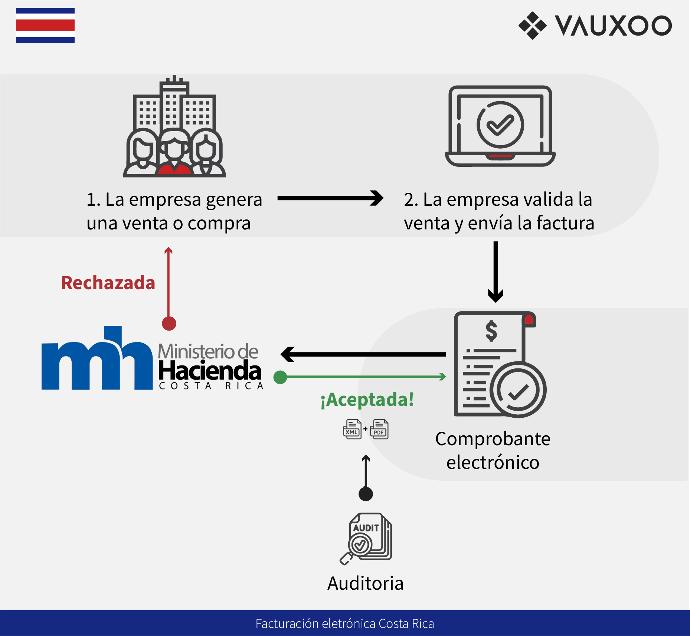

Electronic invoicing process of Costa Rica

Within Odoo, a billing flow is generated that acts with respect to the law of Costa Rica.

In Costa Rica, the billing flow is carried out through the Ministry of Finance, which is in charge of receiving and validating the billing receipts, the electronic invoice is called an electronic receipt. Here is a brief and simple explanation of the billing process:

The company generates a sale within the Odoo system.

The company validates the sale, the XML file is generated, and it sends a request to the Costa Rican Ministry of Finance to validate.

The Ministry of Finance can accept or reject the request, and this status may be visible within the Odoo system.

If accepted, the Ministry of Finance returns the result and the information can be used to carry out the pertinent audits that we are going to need.

Vauxoo electronic invoicing Costa Rica

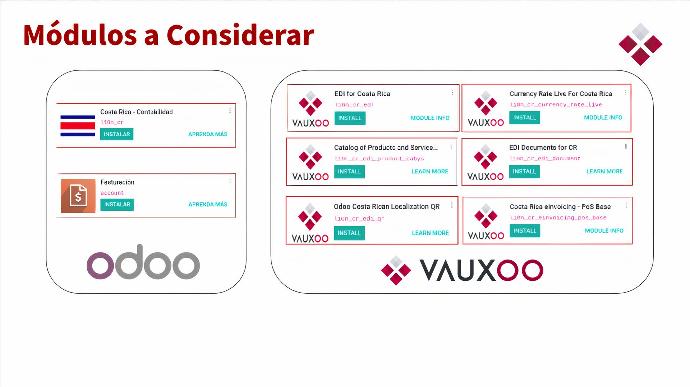

The modules to consider to carry out the electronic invoicing of Costa Rica in Odoo are:

Odoo modules:

Costa Rica - Accounting

Invoicing

Vauxoo modules:

Point of sale

Exchange Rate Settings

Catalog of products and services

Documents for Costa Rica

Vauxoo Costa Rica's electronic invoicing service includes:

Signature and validation of electronic tickets.

Signature and validation of purchase and sale invoices.

Signature and validation of export invoices.

Acceptance of purchase invoices.

VAT validation.

Accounting control of VAT paid and collected.

The sending of the XML, the PDF and the response by mail.

Troubleshooting.

Updates required by Ministerio de Hacienda.

Maintenance.

Version updates in Odoo.

Resolution of faults, bugs and operating errors that depend on our location.

Up to 1,000 free monthly documents. Additional packages.

Electronic invoicing is a necessary process for any company, making use of a tool like Odoo will automate your accounting processes and keep your company's tax obligations in order.