What is a Financial Budget?

A Financial Budget is a planning tool of great importance for companies, since it tries to highlight the economic situation of a business during a certain period. That is to say, this budget is responsible for monopolizing each one of the aspects that may arise at the economic level of a company.

Financial Budget in Odoo

Managing budgets is an essential part of running a business, budgets help people better manage how they spend money, organize and prioritize their work to meet financial goals. Also, they allow planning the desired financial results and measuring the real performance of the plan. With Odoo it is possible to manage budgets by using general and analytical accounts.

Budget Management Configuration

To activate the budget functionality:

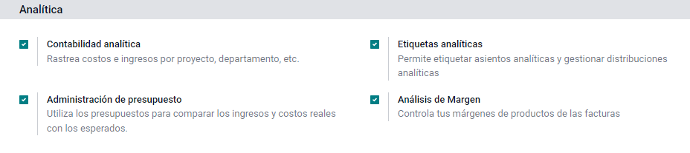

Accounting module > Configuration > Settings > Analytical Accounting

Budget Position in Odoo

Budget items are lists of accounts for which you want to have a budget (usually these are expense or revenue accounts). They must be defined so that Odoo knows which accounts to get the budget information from.

Budget items act as a kind of restriction on what can be recorded in the “practical amount” column of a budget. Each commitment item can have any number of general ledger accounts (the main chart of accounts) assigned to it, it must have at least one.

If you post a transaction that already has an analytic account assigned that is included in a budget line, but one of the general ledger accounts is not included in the budget position of that same budget line, it will not appear in the 'practical amount' column of the budget line.

Budget Management Configuration

To define commitment items:

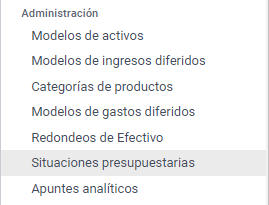

Accounting module > Configuration > Budget Positions

They can also be created within the same budget

What do we use Analytical Accounts for in an accounting budget?

Odoo needs to know what costs or expenses are relevant for a specific budget. To do this, we must link our invoices and expenses to a defined analytical account

Examples for grouping ledger accounts in a commitment item

Income:

Sales and/or services taxed at the general rate

Raw Material Costs:

Sales cost

Received Goods – No Invoices

Bills:

Other expenses

General expenses

Operating expenses

Travel expenses

Other General Expenses