What is fiscal localization?

It is the adaptation of your accounting or business system to comply with the fiscal requirements and regulations of the country where your company is established. Recognizing the specificities of each country, at Vauxoo, we have created fiscal localization packages for different Latin American countries such as Venezuela, Mexico, Guatemala, Costa Rica, and Peru. This time, we want to share with you the one we designed for Ecuador.

These packages include country-specific configurations such as taxes, fiscal positions, chart of accounts, and preconfigured legal statements in the system's database.

Key Concepts to Understand the Use of Localization in Ecuador

SRI: The Internal Revenue Service is the governmental organization responsible for tax payments in Ecuador.

EDI: Electronic Document Interchange.

RUC: Unique Taxpayer Registry, which is the identification number for each taxpayer conducting economic activities in Ecuador.

The types of taxpayers defined by the SRI include natural or legal persons, administrators, or holders of assets subject to taxes.

RIMPE: Simplified Regime for Entrepreneurs and Businesses, which is the qualified taxpayer category for this regime.

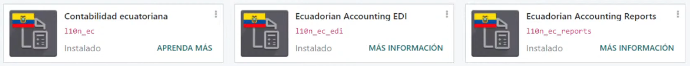

Three Odoo Modules to Cover Localization in Ecuador

Accounting or Base module: This module includes the standard chart of accounts, tax and fiscal position setup, identification and taxpayer types, and support for various types of fiscal documents per journal.

Electronic Invoicing module: This module enables direct electronic invoicing with the SRI through a web service. You can generate documents such as invoices, sales orders, debit and credit notes. It also supports purchase and sales withholdings, as well as purchase settlements.

Financial Reports module: Here, you can access the balance sheet report adapted to Ecuador and the profit and loss report also adapted to Ecuador.

We share with you the process of issuing an electronic invoice in compliance with SRI provisions in Ecuador.

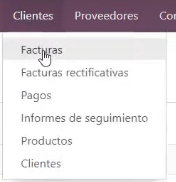

Within your Accounting module, go to Customers.

Create a new invoice. For this example, we will be the customers, so we select Vauxoo.

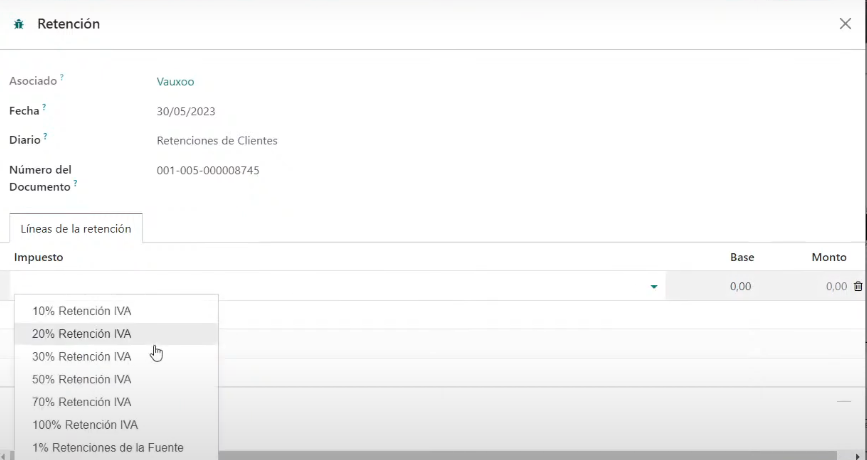

Determine the taxpayer type, choosing from the catalog that specifies the type of taxpayer for this company.

Once you determine the taxpayer type, you can also determine the applicable withholdings.

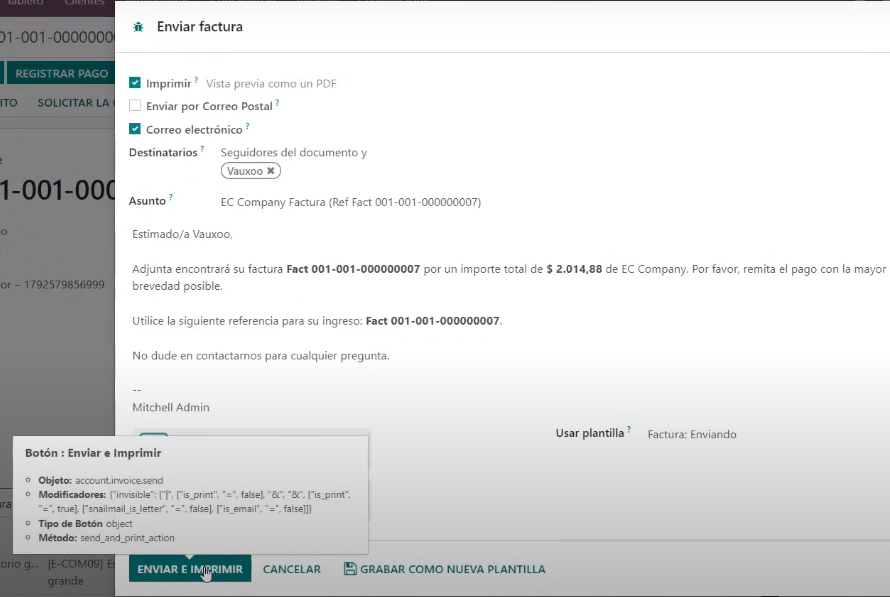

It's time to generate the XML and PDF of your invoice with Ecuadorian fiscal localization in Odoo.

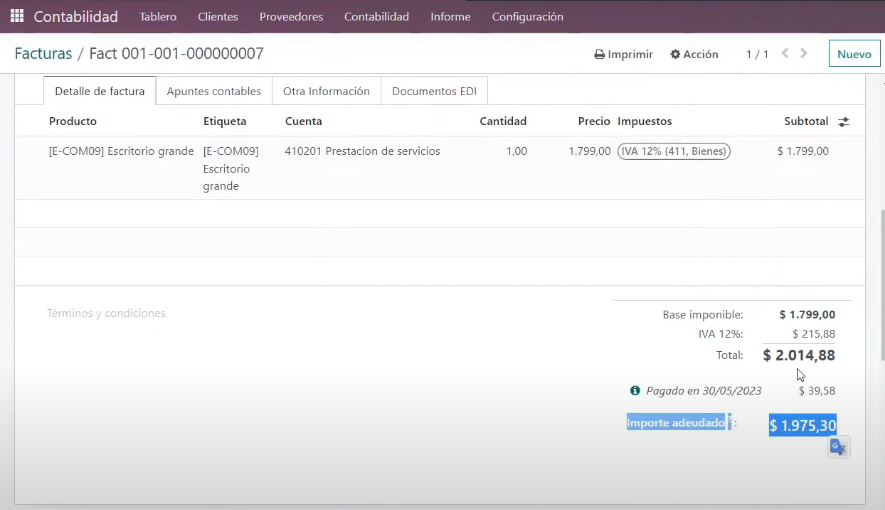

Go back to the invoice and enter the product or service to be invoiced. For this example, let's say it's a desk, and we will choose the payment method without using the Financial System. Odoo automatically sets the document type for this customer.

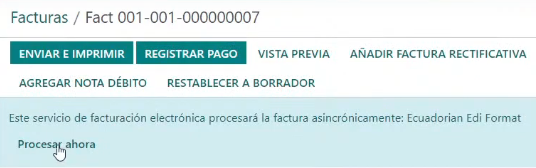

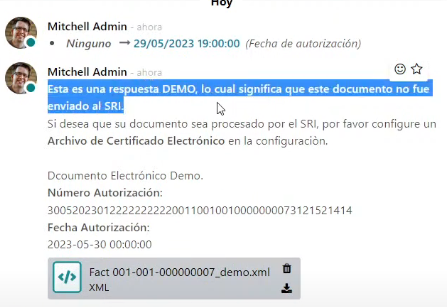

When you confirm, you will see that the document has been generated, and you have an authorization number. The electronic invoice is ready to be sent.

Process the document to generate the XML and PDF.

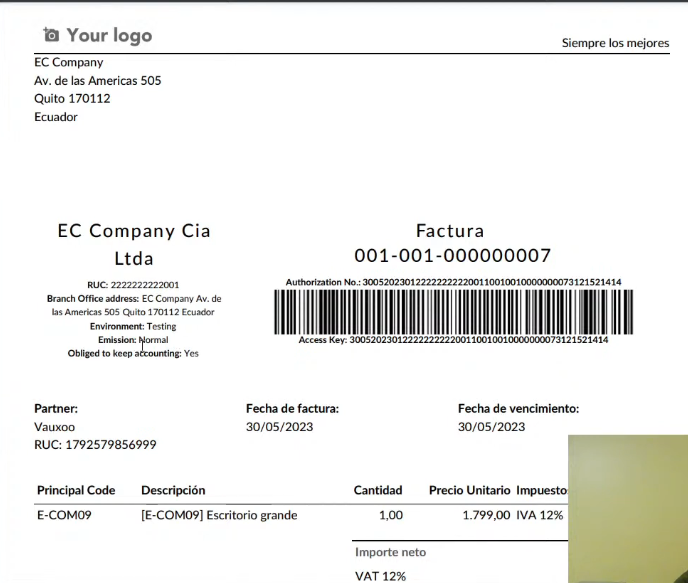

Before sending the invoice to your customer, verify that it complies with SRI requirements, which involve sending the XML and RIDE (Electronic Document Image Reference).

You can now view the issuing company's data. In the case of the invoice, you can see the authorization number and access key. The partner's data, invoice date, due date, and details of the product are also visible.

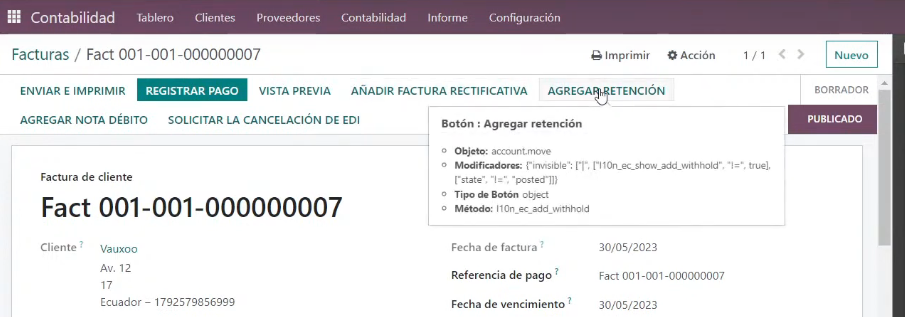

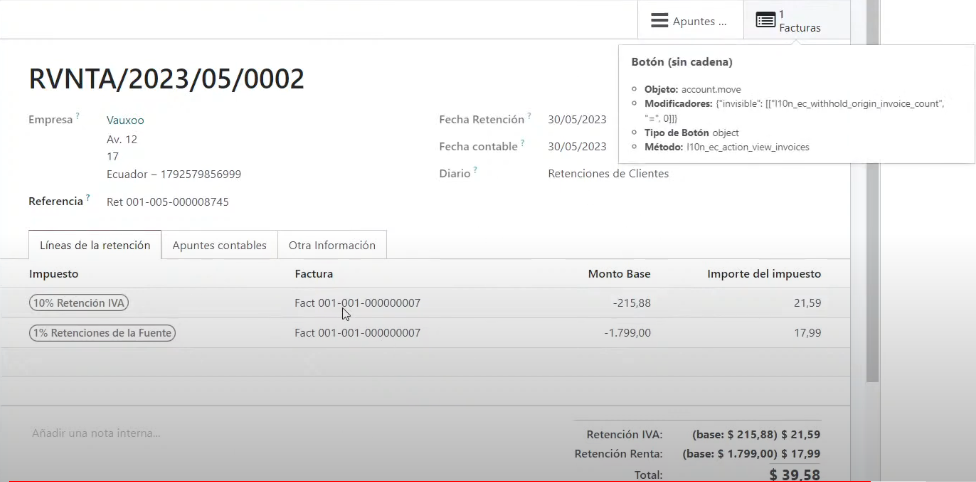

Add the withholding thanks to the Ecuadorian localization in Odoo

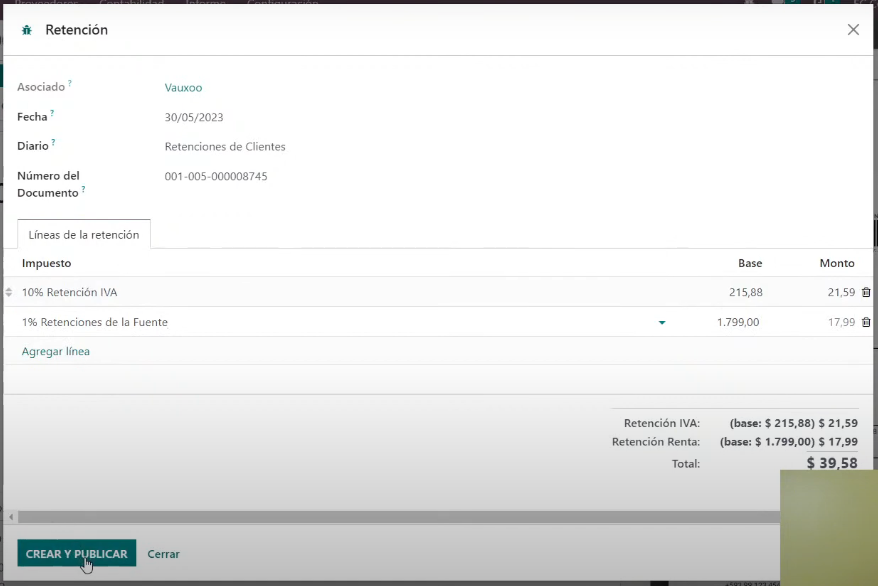

At this point, there is an obligation for the customer to register a payment. That's why the Register Payment button is activated at the top. You should then record any withholding made by the customer.

Implementing the Ecuadorian localization in Odoo with the tools we have developed at Vauxoo not only ensures compliance with fiscal regulations but also provides greater security and accuracy in your sales operations. Make the most of the functionalities of the Ecuadorian localization and boost your sales in the Ecuadorian market.