December is approaching and at the same time the dreaded accounting closure, that’s why we want to share with you five reasons why you should keep your fixed assets updated from Odoo 16, always:

You’ll:

Have a healthy accounting throughout the year.

Be able to deduct the depreciation amount in time.

Know which assets have ended their useful life.

Streamline the accounting closing process.

With a couple of clicks, you will know which goods need to be updated.

Don’t forget to watch the webinar Fixed Assets in Odoo 16 with our Bussiness Consultant, John Cárdenas.

Go to the webinarBut, what are the fixed assets?

If your company has from a desk with a computer to heavy machinery to process large packaging productions, you have fixed assets, because they’re all those goods, tangible as machinery or intangible as a patent, that doesn’t convert into income in the short term, that are usually necessary for the operation of your company and that are not destined for sale, some examples?

Real state.

Machinery and furniture.

Technological equipment.

Company shares and stocks.

Patents or copyrights.

Why have them on Odoo 16?

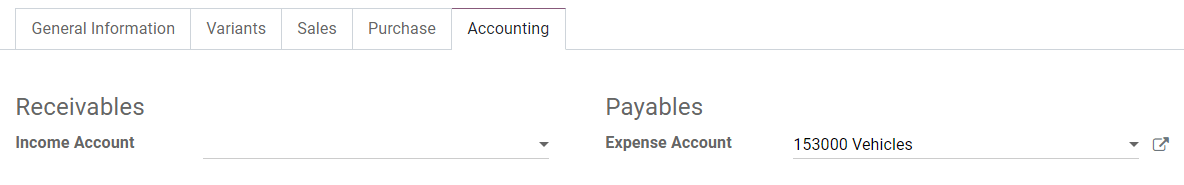

If you have an account that has the accounting section, you can add all your assets there, as well as its depreciation rate, which is nothing more than the decrease in the net value of your assets according to the passage of time or their level of production.

For each type of asset, there is a recommended depreciation rate according to its type of activity and it’s calculated with a formula that allows you to update your books in the best way: straight-line depreciation, declining depreciation, and declining depreciation then a straight line.

But, can you imagine having to manually make all those accounts, with each of your assets? We have good news for you, in the Accounting application of your Odoo 16 database you can periodically update the net value of your assets, giving rise to the necessary updates and purchases so that your company continues to function as well as so far.

How to bring this information to my database?

Some steps before running.

Check that you have de Accounting app installed on your Odoo desktop. From here you can access Accounting Journal, Asset Models, Assets, and Depreciation Schedules.

What function do these configurations have?

From de Accounting journal configuration you can have greater control over your assets, this is where you feed your record of accounting entries linked to your assets.

Path: Accounting ‣ Configuration ‣ Accounting Journal

Active Models allow you to work from the classification of assets such as vehicles, data processing equipment, and machinery, among others.

Path: Accounting ‣ Configuration ‣ Active Models

Of course, Assets, from where you can create all the assets and link them to the previously configurated models. Here you can view all the information on the asset such as its value, acquisition date, book value, depreciation, movement, etc.

Path: Accounting ‣ Accounting ‣ Asset

Finally, the Depreciation Program, where you can access the visualization of the list of assets of your company, method, date of purchase, accumulated depreciation, and book value.

Path: Accounting ‣ Reports ‣ Depreciation

1. Set up an Assets account.

To set up your account in the Chart of Accounts, go to Accounting ‣ Configuration ‣ Chart of Accounts, click Create and fill out the form.

2. Post an expense to the right account.

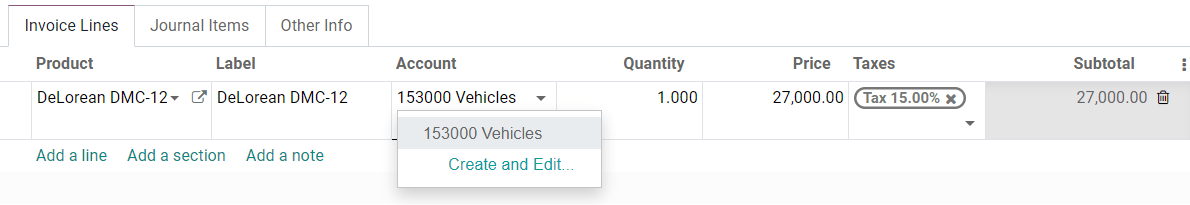

Select the account on a draft bill.

On a draft bill, select the right account for all the assets you’re buying.

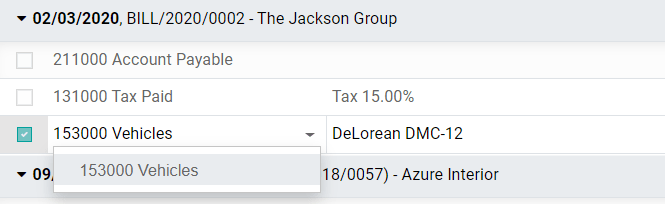

Assets entries.

Create a new entry.

An Asset entry automatically generates all journal entries in draft mode. They are then posted one by one at the right time.

To create a new entry, go to Accounting ‣ Accounting ‣ Assets, click on Create and fill out the form.

Click on select related purchases to link an existing journal item to this new entry. Some fields are then automatically filled out and the journal item is now listed under the Related Purchase tab.

Once this is done, you can click on Compute Depreciation (next to the Confirm button) to generate all the values of the Depreciation Board. This board shows you all the entries that Odoo will post to depreciate your asset and at which date.

That's how easily you can streamline your company's processes, and above all, avoid errors while ensuring the veracity of your information from the Odoo 16 Accounting application.

You’re one click away from streamlining your company’s processes